unrealized capital gains tax meaning

Until the stock is sold the gain or the loss is unrealized. But because you havent cashed in and sold the bitcoin you dont have to report the gain.

The Problems With an Unrealized Capital Gains Tax.

. But of course this only happens when there is an act of selling. Mutual funds with low turnover have large unrealized capital gains. The Democrats have stressed that taxes will not be increased on middle- and working-class Americans.

Short-term capital gains are taxed at your ordinary tax rate. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant reasons why any proposal to make this a reality probably wont make it too far. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a.

Define Unrealized Capital Gains or Losses. The first example is realized because you sold the stock for 1100. Beware the voices who would advocate for taxing unrealized gains in wealth as a source of.

The table below shows. An unrealized gain is an increase in the value of an asset or investment that an investor has not sold such as an open stock position. While a fund that has huge unrealized gains is an indication of a fund that has been successful in picking winners it also poses potential bomb-shells for new investors in the fund.

A new unrealized capital gains tax would be a headache to enforce. Statements to the Congress. Related to Unrealized Capital Gain.

The AFP proposed raising the top capital gains rate and taxing. That said the sold stocks that bring gains or losses are realized. 409 Capital Gains and Losses Source.

The rate youll pay depends on your income and tax filing status. Capital Gains Tax. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings.

Unrealized Gain attributable to any item of Partnership property means as of any date of determination the excess if any of a the fair market value of such property as of such date as determined under Section 55d over b the Carrying Value of such property as of such date prior to any adjustment to be made pursuant to Section 55d. A lot of lies being spread about the proposed unrealized capital gains tax. An unrealized loss is a decrease in the value.

The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. In the second example those are unrealized gains because while youre currently up 10 over your investment if the. You start a successful company and that companys value goes from zero to 1 billion in one year.

In 2022 those rates range from 10 to 37. Although the term unrealized gains or losses is a term thats not heard as often it. For example if you were ahead of the curve and bought bitcoin for 100 and now its worth 9100 you have an unrealized gain of 9000.

If you hold an asset for more than one year before you sell for a capital gain youre eligible for a more favorable long-term capital gains tax. We estimate that taxing unrealized capital gains at death with a 1 million exemption and increasing the tax rate on capital gains and qualified dividends would raise about 213 billion over 10 years lower than other estimates of around 400 billion over that time period. It only targets.

With respect to each Security held by the Partnership on the last day of an Interim Period the difference between i the value of the Security on such date and ii the value of the Security as of the last day of the preceding Interim Period or the adjusted basis of such Security in the case of Securities acquired during the Interim Period. IRS Unrealized vs Realized Capital Gains. So even if the stock crashes or continues to rise it doesnt matter you sold your holdings and locked in a 10 gain.

Unrealized Capital Gains means with respect to a security or other asset the amount by which the fair value of such security or other asset at the end of a fiscal year as determined by the Company in accordance with GAAP and the Investment Company Act exceeds the original cost of such security or other asset as determined by the Company in. If an investment is sold meaning that there is now a new owner of the investment the capital gain is considered to be realized Further if you realize a capital gain post-sale the proceeds are deemed taxable income. So you realized a 10 gain.

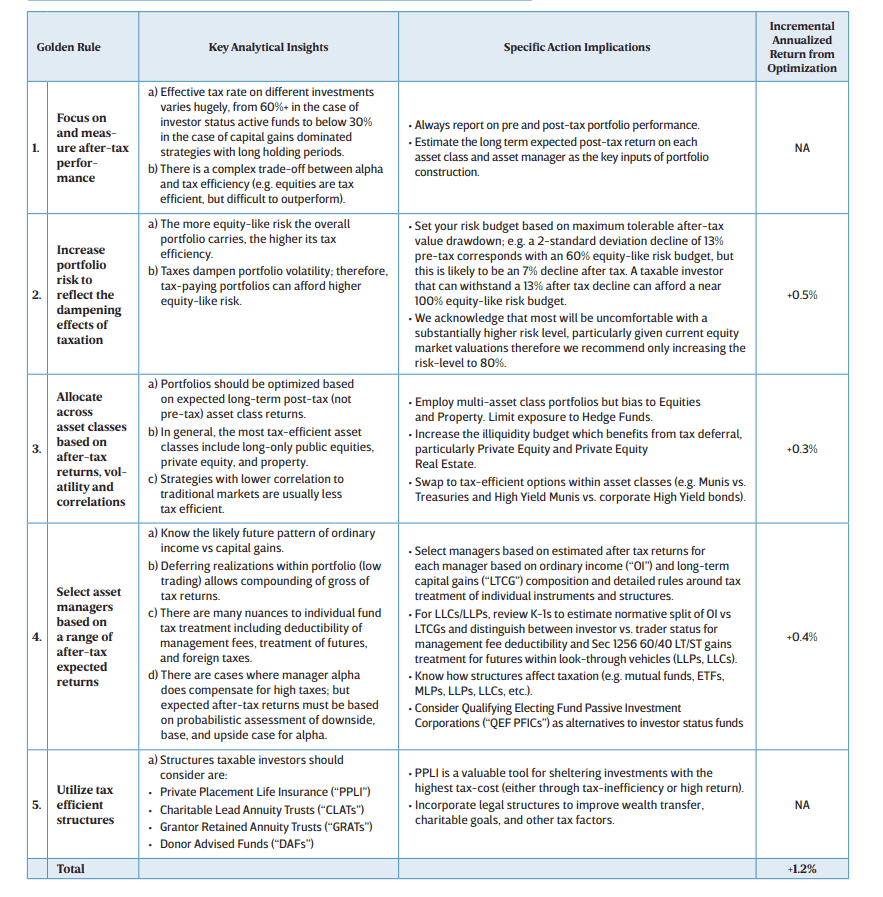

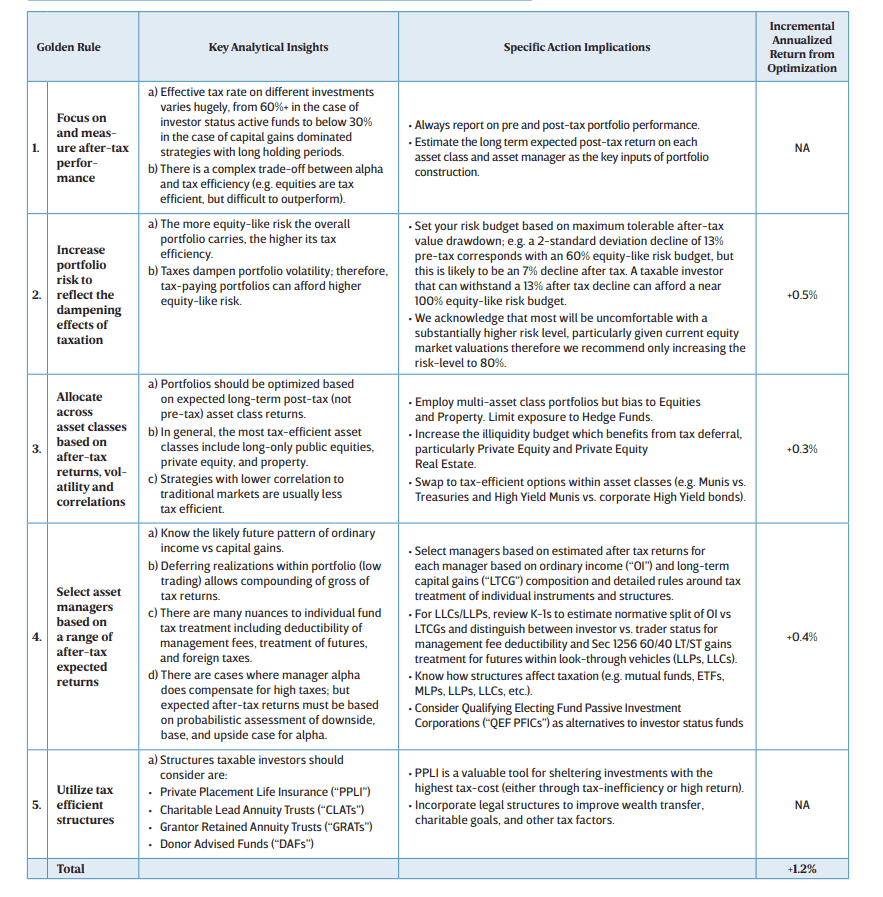

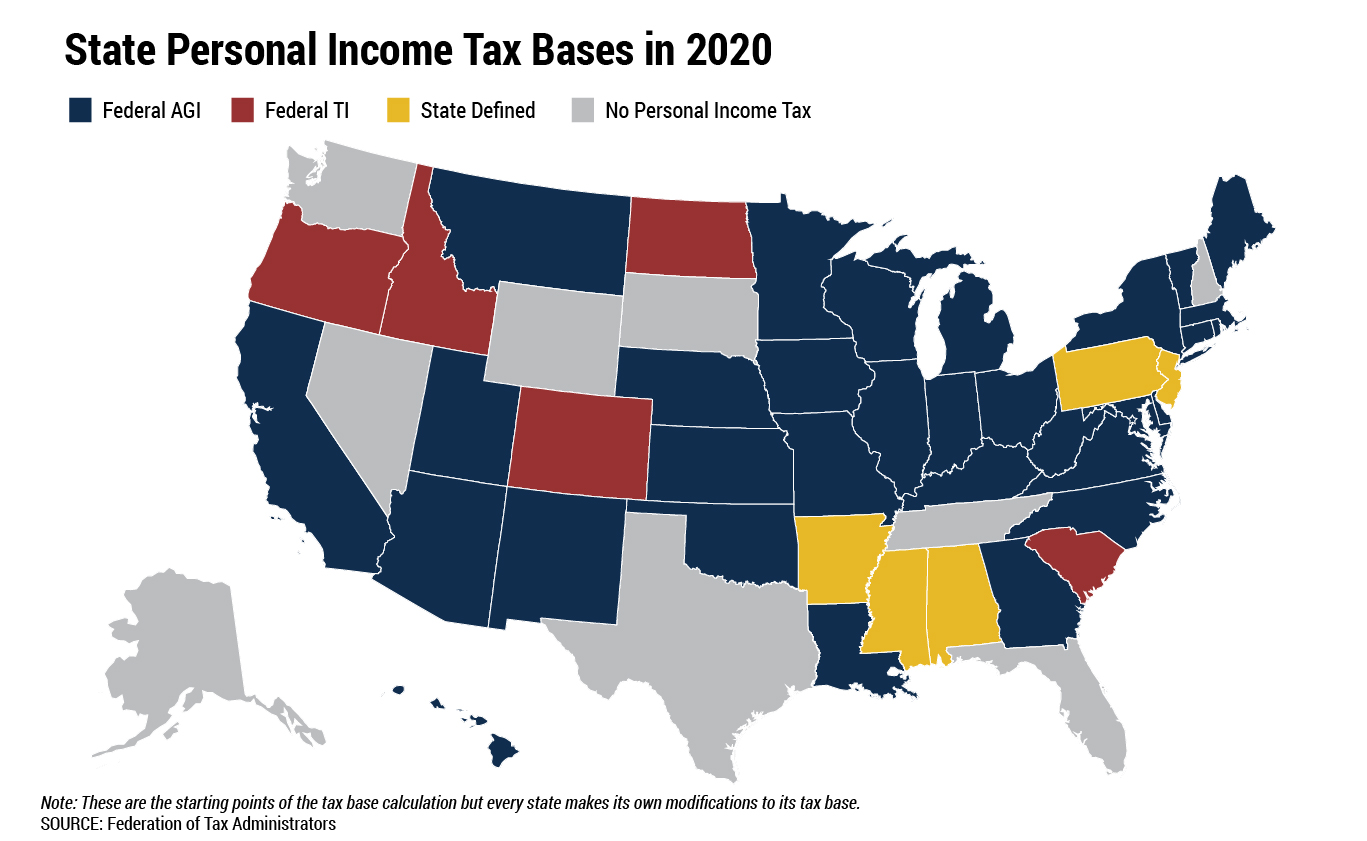

The After Tax Investment Lens The Key To Tax Efficient Investing California Taxpayer Version Partners Capital

The After Tax Investment Lens The Key To Tax Efficient Investing California Taxpayer Version Partners Capital

Capital Gains Tax What Is It When Do You Pay It

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Gain Meaning Types Realized Gains And Unrealized Gains Gains And Taxes Compounding Gains Commerce Achiever Commerce Achiever

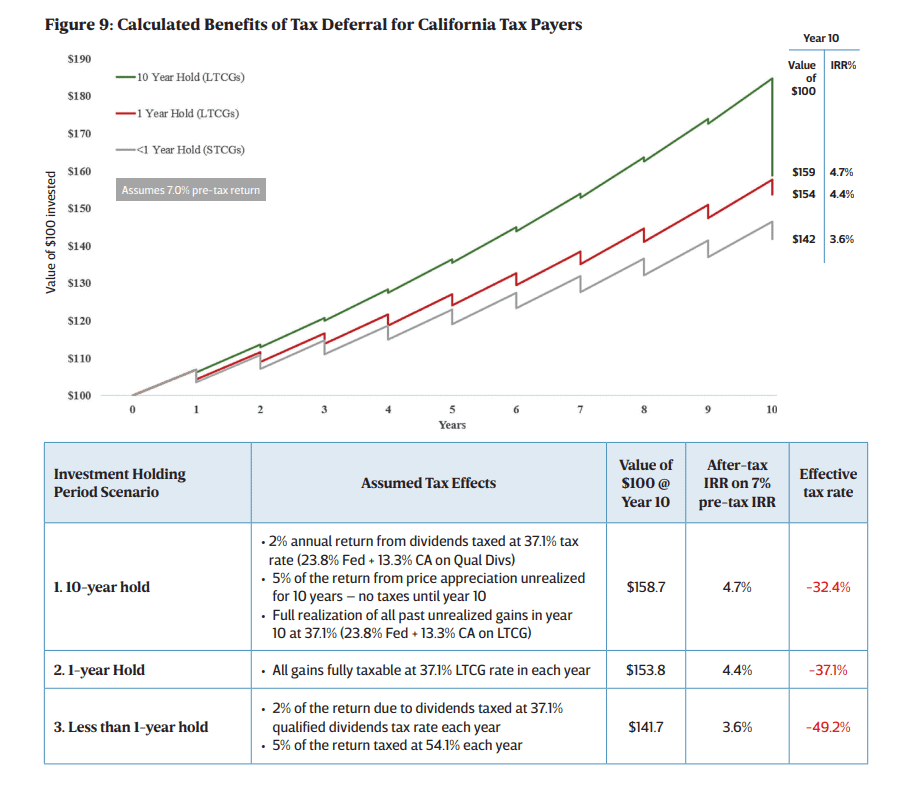

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Confusing U S Tax Laws Lead To 5 Billion In Unrealized Crypto Losses

Asset Allocation Decision Asset Allocation Process Of Deciding

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Other Comprehensive Income Overview Examples How It Works

Capital Gains Tax What Is It When Do You Pay It

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Investing Through A Professional Corporation Physician Finance Canada

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition